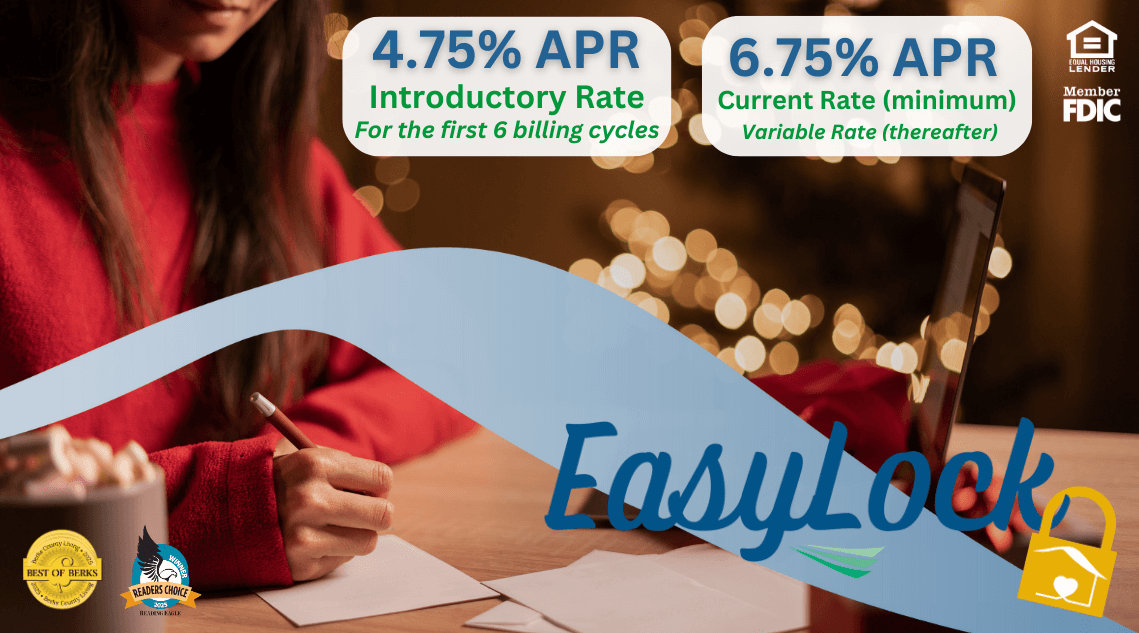

Overspending During The Holidays Is Easy.

Luckily, So Is Consolidating Your Debt.

Lock it or leave it.

With our EasyLock Solution, you choose.

The home equity solution that gives you the best of both worlds -

The flexibility of both a line of credit and a fixed loan!

No more worrying about ruining your good credit rating.

Consolidate into one low monthly payment, and save money with better interest rates than your credit cards.

The advertised Annual Percentage Rate (APR) is effective as of publication date for new money credit lines up to $400,000.00. New money is defined as either a new application or if it is the first draw of an existing Easylock loan. A combination of internal and third-party fees paid in connection with opening the line can range from $255 to $755. A Closing Documentation fee of $125 is due and payable upon signing of loan documents. An early termination fee of 2% of the initial credit limit will be charged if the line is closed within 24 months of being established. Consult a tax advisor for deductibility of interest.

The introductory interest rate will become a variable rate beginning 6 months after loan closing and will be based on Wall Street Journal Prime Rate + margin or a minimum APR of 3.49%, whichever is greater. Following the introductory period, the APR will become the greater of the following: our floor rate of 3.49% or the highest Prime Rate (6.75% as of 12/11/2025) quoted in the Wall Street Journal. Maximum APR is 18.00%.

This account includes a fixed rate option, which is tied to an index, currently Prime Rate, and is dependent on credit history. There is a limit of two (2) fixed rate advances at any one time, with minimum advance of $3,500 and five (5) locks maximum during term of line of credit. Borrower must pay mortgage satisfaction fees at loan termination. This line of credit has a 15 year draw period. By making only the minimum periodic payments each billing cycle for the maximum term, your line of credit will have a maturity balloon payment where all principal, interest, and fees will be due in 15 years from the date the line of credit is established. Please refer to our credit agreement for complete details. Rates and terms subject to change and may be withdrawn without notice.