Check Fraud:

What To Look For And How To Prevent It

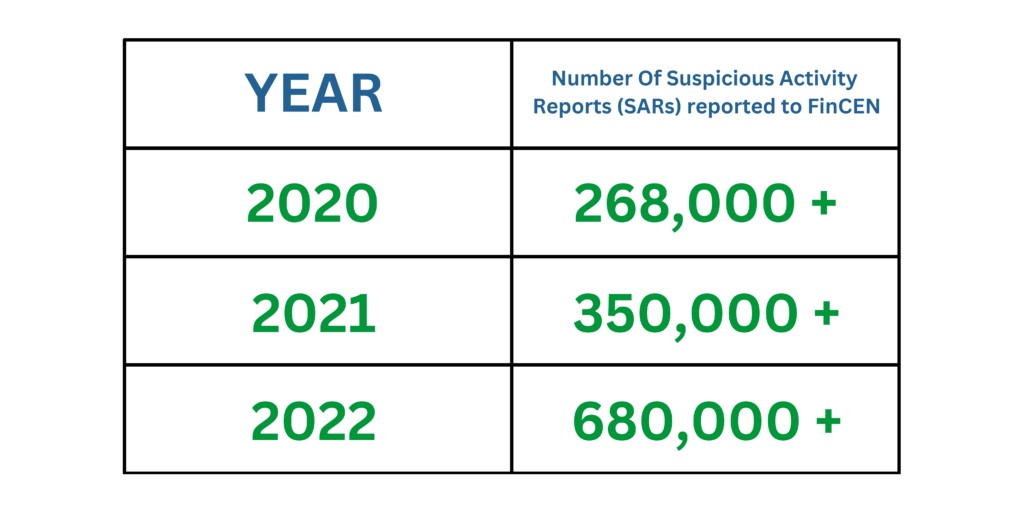

It’s no secret that the days of writing checks have faded away over the years. In fact, according to the Federal Reserve, “the number of checks collected annually has plummeted 82% over the last 30 years.” Even with this steady decrease, banks issued approximately 680,000 reports of check fraud in the last year. This was a number nearly double what was reported in 2021, as illustrated by the chart below:

In February of this year, the Financial Crimes Enforcement Network (FinCEN) issued an alert “notifying financial institutions on the nationwide surge in check fraud schemes targeting the U.S. Mail.” The statement noted that “criminals have been increasingly targeting the U.S. Mail and United States Postal Service mail carriers since the COVID-19 pandemic to commit check fraud.”

According to Frank McKenna, Chief Fraud Strategist at Point Predictive who has helped over 200 finance companies, banks, and lenders achieve reductions in fraud, check fraud will bring in over $24 billion in losses once 2023 comes to a close. This is a roughly 50% increase from the last time it was measured in 2018.

What is fueling this steady increase in check fraud? Opportunity. Check fraud is considered a “low-tech” crime and seemingly easy to pull off. The large pool of potential victims also plays a part. Checks at the well-known drop-off boxes or residential mailboxes are sitting ducks just waiting to be taken advantage of.

Fraud Is No Stranger To Berks County

“The amount of scams we see locally – nearly every day – is unnerving. Check fraud is sadly alive and well in our community,” states Timothy Snyder, President and CEO of Fleetwood Bank. So far in 2023, the Bank has received 34 alerts on account fraud.

One form of check fraud in particular that appeared to be going away but is now back and more prevalent than ever is check washing, or the process of erasing details from checks to allow them to be rewritten. Often, check washing scams involve changing the dollar amount on a check or the payee name to fraudulently deposit them. Removing ink from checks is as simple as having access to chemicals as common as solvents that can be found in every day household items such as nail polish remover.

According to the United States Postal Inspection Service, postal inspectors recover over $1 Billion in counterfeit checks and money orders on an annual basis.

Fleetwood Bank has personally saved customers from losing large sums of money through check fraud in recent months. One example is when a Fleetwood Bank business customer fell victim to a counterfeit business check when a check was created using the business’ checking account number. When our team became aware that a fraudulent check in the amount of $15,000 cleared our customer’s account, we were able to immediately contact the business owners to confirm that all of the checks they personally had written from this account made it to the appropriate vendors. Since the Bank was aware that the fraudulent item was deposited into the suspect’s checking account through another financial institution’s ATM, we were able to submit a Fraud Return request with the other financial institution so the check was rejected and our customer received no financial loss.

“We’ve had customers at risk of losing thousands through check washing recently, so we wanted to be sure to educate our customers and the community as a whole. Awareness is the best strategy to slowing this recent spike in check fraud,” explains Tim Snyder.

Preventative Measures Your Local Bank Is Taking to Mitigate the Chances of Check Fraud:

Day in and day out, our in-house compliance and fraud team is constantly monitoring transactions for any suspicious activity using our robust systems. The compliance team is always reviewing alerts from federal and local agencies about current scams so they can keep all bank employees aware. Additionally, retail staff have identity theft and red flags training, so they can be on the lookout for signs of scams and fraud against our customers.

If you are a business customer at Fleetwood Bank, make sure you sign up for Positive Pay. For an inexpensive fee, you will have peace of mind thanks to email alerts notifying you anytime a check is written. With this service also comes the power to approve checks before they are cashed so you will know immediately if a check has been tampered with. To learn more about this worthwhile product, please reach out to our VP of Business Development / Cash Management, Curin Romich, as she would be happy to discuss the protections that Positive Pay offers.

Tips and Steps You Can Personally Take to Reduce Your Chance of Being Victim to Check Fraud:

According to the Federal Trade Commission, consumers lost nearly $8.8 billion in scams in 2022, and the FTC received fraud reports from over 2.4 million consumers. Here’s some best practices and important reminders to help keep you from becoming part of these alarming statistics:

- Monitor your accounts on a daily basis. Take advantage of Fleetwood Bank’s online banking so you can access your accounts and statements 24/7 via our mobile banking app. This allows you to keep an eye on whether or not a check has cleared.

- When making purchases online, consider using your credit card instead of your debit card. Using your debit card could potentially give criminals direct access to your liquid funds.

- Be on the lookout for phone scams! Often times, scammers will say you were “selected” as a winner or you need to pay taxes or some other debt over the phone immediately in order to avoid being arrested, fined or deported. Never give out your account number or social security number over the phone. The government only communicates through the mail, and Fleetwood Bank will never call you and ask for this information over the phone. If this happens, you should hang up and dial the main line at 610.944.7666 to notify a member of our team so we can put an alert on your account. Even if the caller ID says Fleetwood Bank, you should call us so we are properly notified. Phone numbers can easily be masked or changed in today’s world.

- Be wary of gift card scams! These are currently popular, and they get even worse during the holiday season. If you receive a phone call asking someone to pay them with a gift card in order to do things such as keep your Social Security benefits, keep your utilities on, pay for a family member in trouble, pay bail or ransom, or avoid arrest or deportation you have been victim of a scam. Learn more at ftc.gov/giftcards.

- BanksNeverAskThat.com is another great resource that offers many tips and insight on what to look out for to avoid being scammed.

- If you were scammed or think you saw a scam, it is recommended to report it to the Federal Trade Commission at ReportFraud.ftc.gov.